Six Best Bank of US Stocks to Buy for 2023

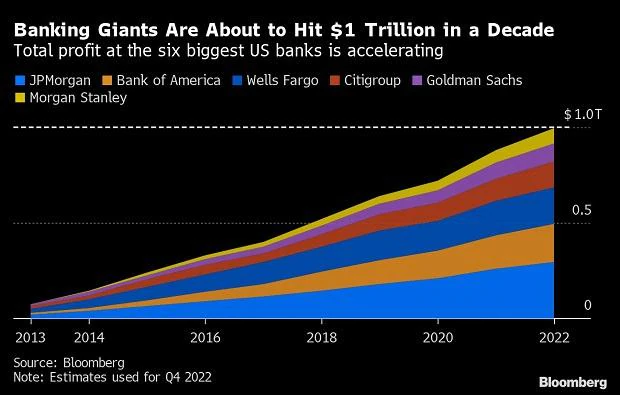

According to Bloomberg report six big banks of wall street hit $ 1 Trillion in a decade.so its a great opportunity for us to invest in big capital holder and profitable banks.

According to data gathered by Bloomberg, they grew instead, easily surpassing corporate America so that JPMorgan Chase & Co., Bank of America Corp., and even hampered Wells Fargo & Co. are on track to make more profit during those 10 years than all but a small number of publicly traded US corporations. Not far behind are Morgan Stanley, Goldman Sachs Group Inc., and Citigroup Inc. The six will likely make considerably more money next year when working together.

we can see the whole data of last 8 years and growth of 6 big banks of wall street.

If you’re missed this opportunity in past so grab it now.the data shows consistent growth so you can also grow your wealth to invest on it.

All bank doing good in market so this is right time to go ahead for the investment.Investing in U.S. banks can be a smart move for investors looking for potentially earn a steady stream of income. Whether you’re a seasoned investor or just starting out, there are several ways to invest in U.S. banks, such as buying stock in a publicly traded bank, investing in a bank-sponsored mutual fund or exchange-traded fund (ETF), or purchasing bonds issued by a bank. In this blog post, we will explore the different ways to invest in U.S. banks, the pros and cons of each method, and the potential risks and how to mitigate them. We will also provide examples and case studies to illustrate key points. It’s important to remember that investing in U.S. banks, or any other type of investment, carries risk. So, before making any investment decisions, it is always wise to consult with a financial advisor.

Why should we invest in U.S. banks?

1.U.S. banks are considered to be relatively stable and consistent performers in the stock market, as they tend to have steady revenue streams and are less affected by market fluctuations compared to other sectors.

2.Banks also provide a source of steady income through dividends and interest payments. Many U.S. banks have a history of paying dividends to their shareholders, and investing in a bank stock can provide a regular income stream for investors.

3.U.S. banking industry is highly regulated, which can help to mitigate risks for investors. Banks are required to follow strict regulations and guidelines, which can help to ensure the stability and security of the financial system and protect investors’ interests.

read more..How make money from NFT, How can we Invest in NFT in a Best way.